- Bitcoin in Action

- Posts

- Embracing Bitcoin: A Glimpse into the Future of Global Finance

Embracing Bitcoin: A Glimpse into the Future of Global Finance

The world of finance is undergoing a significant transformation, and Bitcoin is at the heart of this change. As the first decentralized cryptocurrency, Bitcoin has gained considerable attention and adoption since its inception in 2009. As we move further into the digital age, it's essential to examine the role Bitcoin may play in the future of global finance.

Decentralization and Financial Inclusion

One of the most compelling aspects of Bitcoin is its decentralized nature. Unlike traditional currencies, Bitcoin operates on a peer-to-peer network that enables direct transactions between users without the need for a central authority. This decentralization has the potential to foster financial inclusion by providing access to financial services for people in developing countries or those with limited banking options.

Reduced Transaction Costs and Increased Efficiency

Bitcoin transactions often have lower fees than traditional banking systems, which can lead to significant cost savings for both consumers and businesses. Additionally, transactions can be processed more quickly, providing an efficient alternative to cross-border transactions that typically take several days to clear.

Hedging Against Economic Instability

Bitcoin has gained popularity as a potential hedge against economic instability, particularly in countries experiencing high inflation or currency devaluation. As Bitcoin operates independently of any government or central bank, it can act as a store of value and provide a level of protection against currency fluctuations.

The Integration of Smart Contracts

Smart contracts, self-executing agreements with the terms directly written into code, are another innovation that could propel Bitcoin's role in the future of global finance. These contracts can facilitate complex transactions and automate various financial services, potentially revolutionizing industries such as insurance, real estate, and supply chain management.

Regulatory Challenges and Scalability

Despite its potential benefits, the widespread adoption of Bitcoin faces several challenges. Regulatory uncertainty and the lack of a standardized legal framework may hinder its growth, as governments grapple with concerns about money laundering, tax evasion, and consumer protection.

The Lightning Network is a second-layer payment protocol built on top of the Bitcoin blockchain. It aims to address the scalability issues associated with Bitcoin by enabling faster and cheaper transactions, particularly for smaller amounts.

The Lightning Network works by creating off-chain payment channels between users. Instead of recording every transaction on the blockchain, only the opening and closing balances of the payment channels are recorded. This allows users to conduct multiple transactions between each other without needing to update the main Bitcoin blockchain, reducing transaction fees and increasing the speed of transactions significantly.

As the Lightning Network continues to develop and gain adoption, it holds the potential to further enhance Bitcoin's utility as a means of payment and facilitate its growth as a widely-accepted digital currency.

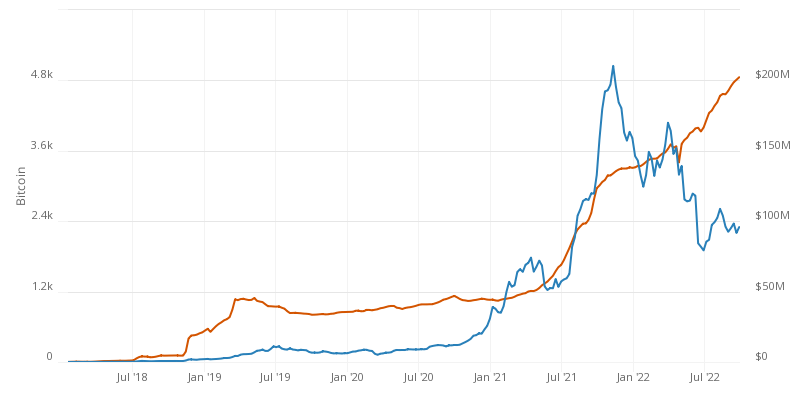

Here are some useful visual charts about Bitcoin and the Lightning Network.

Conclusion

As the world becomes increasingly digital, Bitcoin has the potential to play a significant role in the future of global finance. Its decentralized nature, faster and lower transaction costs, and potential for financial inclusion make it a promising alternative to traditional financial systems. However, for Bitcoin to fully realize its potential, the challenges of regulation and scalability are being addressed.

On Twitter

Consider a #Bitcoin Strategy.

— Michael Saylor⚡️ (@saylor)

8:19 PM • Apr 11, 2023

JUST IN: 🇸🇻 Bitcoin Bonds issuer Bitfinex granted full license in El Salvador

#Bitcoin Bonds incoming 🚀

— Bitcoin Magazine (@BitcoinMagazine)

6:11 PM • Apr 11, 2023

"If you're not paying attention, you should be"

"#Bitcoin is up +80% this year"

"People want to hold a decentralized asset. They don't want to trust a stablecoin, developer, bank, or intermediary. #Bitcoin is the ₿reakthrough", explains @DylanLeClair_

— Documenting ₿itcoin 📄 (@DocumentingBTC)

12:12 AM • Apr 12, 2023

#Bitcoin closed UP for 3 months in a row‼️ This has signalled the start of a new BULL MARKET 3 times without fail.

Bears rekt! 😅

— Bitcoin Archive (@BTC_Archive)

11:07 AM • Apr 11, 2023

#Bitcoin is the fastest horse in the race! And #ElSalvador is the only country in the world riding that horse!!

— Max Keiser, sr. bitcoin advisor to Pres. Bukele (@maxkeiser)

4:19 PM • Apr 11, 2023

BREAKING‼️ 🇨🇳 Tik-Tok in China now shows the #Bitcoin price when searched. It has 600 MILLION users.

— Bitcoin Archive (@BTC_Archive)

3:00 PM • Apr 11, 2023

Here are the 7 most important pieces to understand the seismic shift happening now in global money.

#1 - The US Dollar is losing its status as the world's reserve currency.

China wants the crown - but another challenger has already won. And nobody realizes it yet. #Bitcoin

— Jesse Myers (aka, Croesus 🔴 "crease-us") (@Croesus_BTC)

2:50 PM • Apr 11, 2023

Pro-#Bitcoin 🇺🇸 US Congressman: "Sound money is essential for defending freedom." 👏

— Bitcoin Magazine (@BitcoinMagazine)

2:34 PM • Apr 11, 2023

If you are an environmentalist, the question you need to be asking yourself is why did THIS get a front page spread in the @nytimes?

#bitcoin is already the greenest energy consuming industry on earth, & becomes greener by the day.

It is a rounding error on global CO2. http

— Bit Paine ⚡️ ⛓ 648 (@BitPaine)

12:23 AM • Apr 12, 2023

Living the Bitcoin Standard. Paying fiat bills with #bitcoin Lightning ⚡️

Why? Because we get Sats back!

Support the circular economy.

Support the network.Thanks to @bitrefill

— ⚡️Nicki & James in El Salvador 🇸🇻 (@njelsalvador)

5:45 PM • Apr 11, 2023

Memes

Hold up, working on #Bitcoin

— Thomas Fahrer (@thomas_fahrer)

12:01 AM • Apr 12, 2023

How it feels to HODL #bitcoin at $30k 🚀

Share your best Bitcoin meme videos below!

— The Bitcoin Conference (@TheBitcoinConf)

11:35 PM • Apr 11, 2023

You CANNOT stop #Bitcoin

— The ₿itcoin Therapist (@TheBTCTherapist)

4:32 PM • Apr 11, 2023

Most won't start buying #Bitcoin until a new ATH

If you can’t handle the big drops, you don’t deserve the big gains 😉

— Bitcoin Magazine (@BitcoinMagazine)

8:41 PM • Apr 11, 2023

#Bitcoin waits for NO ONE.

— The ₿itcoin Therapist (@TheBTCTherapist)

9:00 AM • Apr 11, 2023

“What’s the best crypto asset? Well, #Bitcoin’s the best crypto asset. What’s the second best? There is no second best.” — @saylor

— Walker⚡️ (@WalkerAmerica)

4:02 PM • Apr 11, 2023

#Bitcoin Meme of the Day

— Swan.com (@SwanBitcoin)

4:12 PM • Apr 11, 2023

#Bitcoin Meme of the Day

— Swan.com (@SwanBitcoin)

2:53 PM • Apr 10, 2023